In Real Life: Crypto Crash

What was behind the collapse of crypto giant FTX? And what does it say about other digital currencies, and the collision of tech and finance?

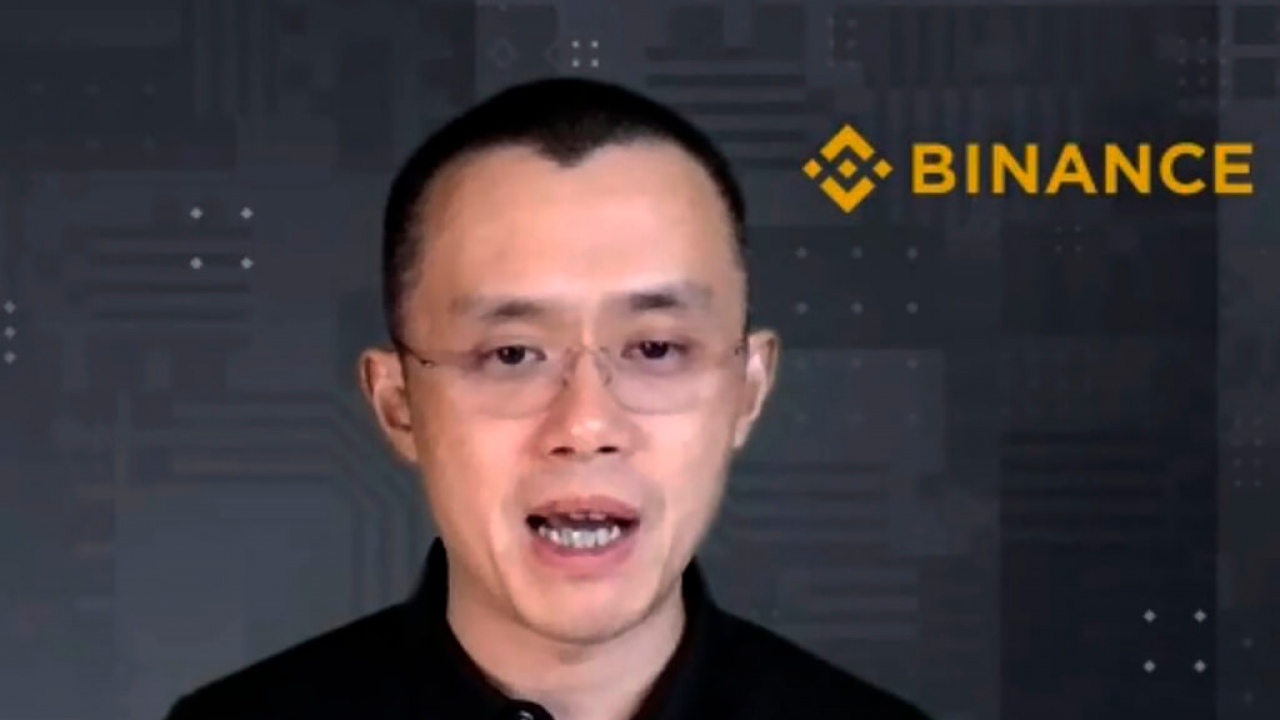

LEARN MOREThe Securities and Exchange Commission says Binance was intentionally trying to avoid regulation.

25 million U.S. students use diesel-powered school buses daily, prompting debates on cleaner alternatives.

The British military earlier said there had been a suspected drone attack and explosions in the Red Sea, without elaborating.

While the details of what led to the knife attack are still unclear, police said they believe the suspect and victims were all family members.

40% of engagements take place between Thanksgiving and Valentine's Day, according to industry experts.

CBP officials say the Tucson area, including Nogales, is already seeing the highest number of migrants coming into the country.

25 million U.S. students use diesel-powered school buses daily, prompting debates on cleaner alternatives.